The internationalisation strategy: key elements and different types

The internationalisation strategy is a business plan to guide companies’ commercial transactions taking place between entities in different countries. It can cover either the company’s supply chain or its sales or it can also cover both of these business functions. In other words, the internationalisation process does not only refer to selling products abroad, it can also refer to buying or manufacturing products (or parts of them) in countries different from the one where the company was originally established. The design of a comprehensive, consistent, successful internationalisation strategy requires analysing international markets and resources, defining goals, understanding market dynamics and developing different scenarios and it should answer these questions: WHY? WHERE? HOW?

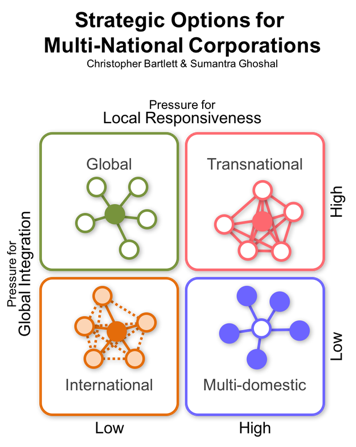

5.1.1. Barlett & Ghoshal Model: different types of internationalisation strategies

Once a business has decided why and where they are expanding internationally, they then need to think about how to expand and decide on the type strategy to adopt and implement. This analysis is based on the Barlett & Ghoshal Model which focuses on two main forces that raise a series of questions, as follows:

Force for local responsiveness:

- Do customers in each country expect the product to be adapted to meet local requirements?

- Do local companies have an advantage based on their ability to be more responsive?

Force for global integration:

- How important is it for the product standardisation to operate efficiently?

- Is a consistent global branding approach required in order to achieve international success?

These strategies help companies to achieve profitable growth in different global markets. In this chapter the differences among these strategies will be analysed and their benefits and risks will be outlined, thus enabling businesses to choose which strategy is the most suitable one for them.

5.1.2. Multidomestic Strategy: Low Integration and High Responsiveness

Companies adopting a multidomestic strategy aim to meet the needs and requirements of local markets worldwide by customising and adapting their products and services extensively. Additionally, they have little pressure for global integration. Consequently, multidomestic firms often have a decentralised structure with subsidiaries operating with relatively high autonomy and independence.

Advantages

- Maximise benefits of meeting local market needs through extensive customisation

- Local businesses treated as separate businesses

Example

Disadvantages

- Decision-making decentralised

- Different strategies for each country

5.1.3. Global: High Integration and Low Responsiveness

Global companies are the opposite of multidomestic companies. They offer a standardised product across the world and aim to maximise efficiencies to reduce costs as much as possible. Global companies are totally centralised, and the subsidiaries have a big dependence on their headquarters. Their main role is to implement the parent company’s decisions, acting as pipelines of products and strategies. This model is also known as the Hub and Spoke model.

Advantages

- Highly centralised

- Focus on efficiency (economies of scale)

- Standardised products

Example:

Disadvantages

- Little sharing of expertise

5.1.4. Transnational: High Integration and High Responsiveness

Transnational companies have characteristics of both global and multidomestic firms and aim to maximise local responsiveness, but also to gain benefits from global integration. Companies produce and sell somewhat unique and standardised products in different markets. With this strategy, the firm tries to combine the benefits of global scale efficiencies with the advantages of being locally responsive; it simultaneously requires both centralisation and decentralisation. Managers have to think globally, but also customise products to the local markets.

Advantages

- Global promotion of the product

- Maximise local responsiveness, but also gain benefits from global integration

- Wide sharing of expertise (technology, staff, etc.…)

Example:

Disadvantages

- Complex to achieve

- Requires many economic resources

5.1.5 International: Low Integration and Low Responsiveness

An international company has little need for local adaption and global integration. The majority of the value chain activities is kept at the company headquarters. This strategy is also often referred to as an export strategy. Products are produced in the company’s home country and sent all over the world. Subsidiaries, if any, function more like local distribution channels. Large wine producers from countries such as France and Italy are great examples of international companies.

Advantages

- Low adaptation to the local markets

- Decisions made in company headquarters.

- Production in origin of company

Example:

Disadvantages

- Possible product incompatibility

- Logistic costs

5.1.6. Common international-expansion entry modes

The most common market entry modes will now be discussed. The strategies are split into equity and non-equity modes, depending on the level of commitment each mode requires. A non-equity model is a strategy where an organisation expands into new markets without having to make investments in areas such as local facilities. On the other hand, an equity model is close to customers. Market entry choice depends on a large number of factors, such as company resources, product characteristics and market distribution. Companies do not always use the same strategy for all markets.

Exporting

Typically exporting is the easiest way to enter an international market, it involves the sale of products and services overseas from the home country using agreements with a local company, distributor or agent.

Advantages

- Fast entry

- Low risk

Disadvantages

- Low control

- Low local knowledge

- Impact of transportation

Licensing and Franchising

Licensing and franchising are business arrangements in which one company gives another company permission to manufacture its product for a specified payment.

Advantages

- Fast entry

- Low cost

- Low risk

Disadvantages

- Less control

- Licensee may become a competitor

- Legal and regulatory issues

Partnering and Strategic Alliance

Partnering and strategic alliances involve contractual agreements between two or more enterprises stipulating that the involved parties will cooperate in a certain way and for a certain time period to achieve a common purpose.

Advantages

- Shared costs and investment reduced risk

- Seen as local entity

Disadvantages

- Higher cost than others

- Integration problems between two corporate cultures

Acquisition

An acquisition is where a firm gains control of another firm by purchasing its stock, exchanging the stock for its own, or, in the case of a private firm, paying the owners a purchase price.

Advantages

- Fast entry

- Knowledge

- Established operations

Disadvantages

- High cost

- Integration issues with HQ

Greenfield venture

A greenfield venture involves the process of establishing a new, wholly owned subsidiary (also called a greenfield venture). This is often complex and potentially costly, but it affords the firm maximum control and has the most potential to provide above average returns

Advantages

- Local market knowledge

- Can be seen as an insider who employs locals.

- Maximum control

- seen as local entity

Disadvantages

- High cost

- High risk due to the unknown Slow entry due to setup time